Introduction

Life in the unorganized sector can be unpredictable. Farmers, drivers, construction workers, and daily wage earners seldom have a retirement plan. That’s why the government launched the Atal Pension Yojana (APY) on 1 June 2015— to ensure every Indian worker can look forward to a dignified old age.

APY offers a fixed monthly pension after the age of 60, based on what you contribute when you’re working. It brings peace of mind, because you know your family won’t be left without income after retirement.

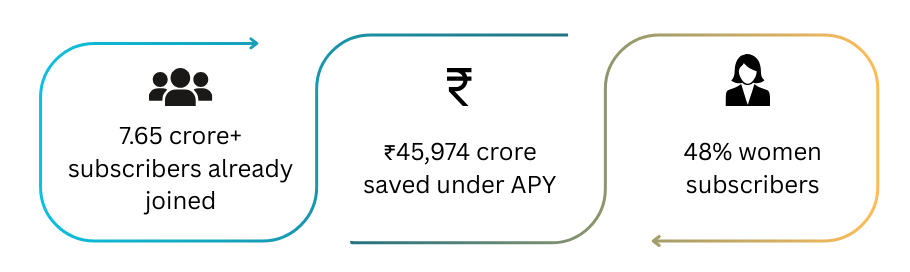

As of April 2025, over 7.65 crore people have joined APY, and the total savings pot is nearly ₹45,974 crore. Women make up almost 48% of subscribers, making the scheme a lifeline for many families.

Your Pension Choice, Your Monthly Contribution

With APY, you choose a pension between ₹1,000 and ₹5,000 a month, and after you turn 60, you get it guaranteed — with no more worrying about money for daily needs.

Your monthly contribution depends on your age of entry and the pension amount chosen. The earlier you start, the less you pay each month. The table below gives a clear picture.

| Age | ₹1,000 Pension | ₹2,000 Pension | ₹3,000 Pension | ₹4,000 Pension | ₹5,000 Pension |

|---|---|---|---|---|---|

| 18 | 42 | 84 | 126 | 168 | 210 |

| 20 | 50 | 100 | 150 | 198 | 248 |

| 25 | 76 | 151 | 226 | 301 | 376 |

| 30 | 116 | 231 | 347 | 462 | 577 |

| 35 | 181 | 362 | 543 | 722 | 902 |

| 40 | 291 | 582 | 873 | 1164 | 1454 |

Penalty for Delayed Payments

Like all savings schemes, APY also requires discipline. If you miss or delay your contribution, the bank will add a small extra charge. This charge depends on how much you contribute every month:

- ₹1 per month – for contributions up to ₹100/month

- ₹2 per month – for contributions between ₹101–₹500/month

- ₹5 per month – for contributions between ₹501–₹1,000/month

- ₹10 per month – for contributions above ₹1,001/month

But here’s the good news: these extra amounts are not lost. They stay in your account and will be added to your pension savings (corpus).

Did You Know? 🤔

When APY first started, the Government of India also stepped in to give a little extra support. For those who joined before 31st December 2015, the government added 50% of the yearly contribution (or up to ₹1,000) for five years.

This was meant to encourage people to start saving early. The money was directly credited into the subscriber’s account at the end of each year.

Even though this benefit was only for the early years, the government still guarantees your pension after 60 — making APY one of the safest retirement plans for workers and families.

But What Happens If You Miss Payments?

This is known as Lapsation – your benefits have stopped because you failed to do something.

Sometimes, due to financial pressure, contributions may get delayed. Don’t worry — your APY account doesn’t get erased. Instead, here’s what happens:

| Months Missed | Status |

| 6 months | Frozen |

| 12 months | Deactivated |

| 36 months | Closed |

But remember: your account isn’t gone forever. Your pension benefits remain intact once the account is reactivated.

Need to Reactivate Your APY Account?

Sometimes, due to missed contributions, your APY account may get lapsed. This does not mean you lose your savings — it simply needs to be renewed. The process is simple, and once you restart, your pension journey continues without any problem.

We have created a step-by-step guide to help you bring your APY account back on track.

👉 [Link Here]

APY’s Reach Is Growing Fast

APY is not standing still — its reach is expanding every year. As of July 2025, total enrolments have crossed 8 crore people, with 39 lakh new subscribers added just this financial year. This shows how vital the scheme has become in securing futures across India.

- Gender Dynamics Over Time

- Another encouraging trend is participation by women. Over the years, APY has encouraged more equitable enrollment. Nearly half of all subscribers are women, showing how the scheme has become a safety net for entire families.

APY Enrolments by State

Although APY is available across India, enrolment is higher in a few key states:

- Uttar Pradesh – 16%

- Bihar – 10%

- Maharashtra – 8%

- West Bengal – 8%

- Tamil Nadu – 7%

- Other states/UTs – 51%

This shows how regional awareness and informal sector size shape participation. Expanding outreach to the rest of the country could further boost impact.

Withdrawal Rules in APY

A common question is — “Can we take out money from the Atal Pension Yojana before 60?” The answer is: only in special cases. The scheme is mainly designed for old-age pension, so the money is meant to stay until retirement.

Here are the main rules:

- Normal Exit (at 60 years): You can leave the scheme after 60 and start getting a fixed monthly pension for life.

- Early Exit (before 60 years): Normally not allowed. But in case of serious illness or exceptional situations, you may withdraw.

- In case of Death: If the subscriber dies before 60, the spouse can continue the scheme or withdraw the money. If the subscriber dies after 60, the spouse will keep getting the pension. After the spouse’s death, the remaining amount goes to the nominee.

- Voluntary Exit: You will only get back your own money + the interest on it.

Maturated APY Cases (Subscribers Who Started Receiving Pension)

- Total APY Subscribers (as of April 2025): Over 7.65 crore.

- The scheme is still young—most subscribers have not yet reached retirement age, so settlements/maturations are just beginning.

How Many People Have Dropped Out of APY?

Even though APY is meant as a long-term pension plan, some subscribers do cancel their memberships. Across India:

- 15.4% of accounts were closed by the end of 2024.

Some states saw even higher rates:

- Punjab: 20.4% opt-out rate

- Uttar Pradesh: 19.3%

- Haryana, Uttarakhand, Andhra Pradesh, MP, Delhi, Chandigarh: All between 16–19%

These numbers show that life’s financial challenges do prompt early exits for a significant minority. But for most, APY remains a committed path toward retirement.

FAQs

Q1. Who is eligible to join Atal Pension Yojana (APY)?

Any Indian citizen between 18–40 years with a savings account can join APY. It is part of the larger Jan Surakshamission to give social security to all workers.

Q2. How much monthly pension will I get?

Depending on your contribution and entry age, you can receive a guaranteed pension of ₹1,000 to ₹5,000 per monthunder the Atal Pension Yojana. This ensures pension for all in old age.

Q3. What if I miss my monthly contribution?

If you delay payments, your account may get frozen or deactivated. But once you pay the pending amount, it will be reactivated. This makes APY a reliable scheme for retirement security.

Q4. Can I exit APY before 60 years?

Normally no, since APY is mainly designed for old-age income. Early exit is only allowed in case of serious illness or death. That’s why it is seen as a strong social security plan.

Q5. What happens if the subscriber dies?

If the subscriber dies before 60, the spouse can continue the scheme or withdraw the money. After both pass away, the nominee receives the remaining corpus — ensuring a secure future for the family.

Q6. Can I change my pension amount later?

Yes. Subscribers can increase or decrease their pension slab (₹1,000 to ₹5,000) once every year depending on their income. This flexibility makes APY one of the most practical government schemes for workers.

Q7. Is APY safe and guaranteed?

Yes. Since it is backed by the Government of India, Atal Pension Yojana guarantees a fixed monthly pension for life. That’s why it is trusted as a long-term retirement security plan.